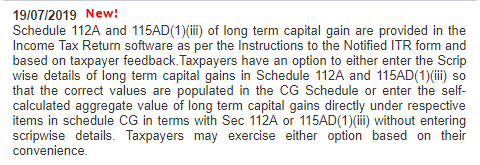

On July 19, 2019, the Income Tax Department has issued a clarification that the taxpayers have an option to entre the aggregate value of long term capital gains or script-wise details whichever is preferred by them.

To arrive at Schedule CG, details of long term capital gain as per section 112A in Schedule 112A and 115AD(1)(iii) in Schedule 115AD(1)(iii) proviso needs to be provided. Based on the feedback of inconveniences faced by the taxpayers; the Government has issued a clarification for Taxpayers to give details of LTCG is either of the manners.

Either enter the scrip-wise details of long term capital gains in Schedule 112A and 115AD(1)(iii) so that the correct values are populated in the CG Schedule

Or enter the self-calculated aggregate value of long term capital gains directly under respective items in schedule CG in terms with Sec 112A or 115AD(1)(iii) without entering script-wise details.

Conclusion

CBDT has relaxed the requirement aaaa given an option to the taxpayers to exercise either of the options as per their convenience. This will help taxpayers to reduce the burden and help in quick filing of return

Source: